Tax is simply money collected by government to run the country. It is used to provide roads, security, hospitals, schools, electricity projects, and other public services.

In Nigeria, taxes are collected by three major authorities:

- Federal Inland Revenue Service (FIRS) – Federal taxes

- State Internal Revenue Service (SIRS) – State taxes

- Local Government Revenue Committees – Local taxes

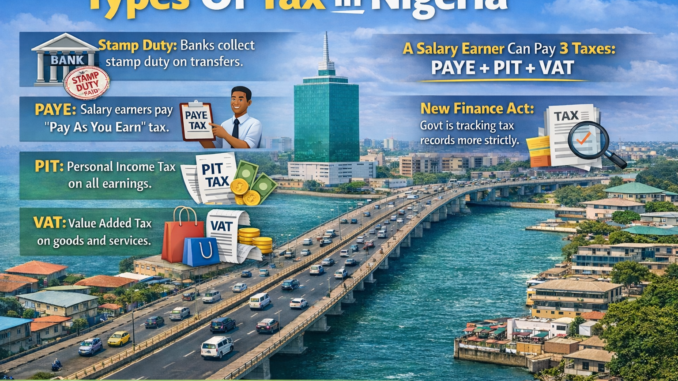

With the new tax reforms and the recent Finance / Tax Acts, government is paying more attention to tracking income, bank transactions, and business records. This makes it important for individuals and businesses to understand the types of tax they may be paying already sometimes without realizing it.

Below are the major types of taxes in Nigeria, explained in very simple and practical terms.

Contents

- 1. Personal Income Tax (PIT)

- 2. Pay As You Earn (PAYE)

- 3. Value Added Tax (VAT)

- 4. Company Income Tax (CIT)

- 5. Withholding Tax (WHT)

- 6. Stamp Duties

- 7. Capital Gains Tax (CGT)

- 8. Education Tax

- 9. Levies and Local Government Taxes

- The New Tax Act and Recent Reforms

- Key Takeaways

- FAQs

- Can one person pay more than one tax in Nigeria?

- Is PAYE different from Personal Income Tax (PIT)?

- Do salary earners pay VAT?

- Why do banks deduct ₦50 on some transfers?

- If VAT is 7.5%, who actually pays it?

- Is Withholding Tax (WHT) an extra tax?

- Do unemployed people pay tax?

- 8. Can government track my income through my bank account under the new tax law?

- Do I need to register with the tax office if I’m self‑employed?

- What happens if I don’t pay tax?

1. Personal Income Tax (PIT)

Personal Income Tax is tax paid by individuals on their income.

Who pays PIT?

- Salary earners

- Self-employed people

- Business owners

- Freelancers and professionals

For salary earners, PIT is usually collected if they have other source of income other than their salary.

Example:

If you earn money as a freelancer, consultant, trader, or realtor, and you are not on a company payroll, you are expected to file and pay Personal Income Tax to your state government.

2. Pay As You Earn (PAYE)

PAYE is the most common tax for salary earners.

It is deducted directly from your salary by your employer and paid to the state government on your behalf.

Example:

If your monthly salary is ₦300,000, your employer will deduct PAYE every month and pay it to the Lagos State Internal Revenue Service (or the relevant state).

You do not pay PAYE yourself your employer handles it.

3. Value Added Tax (VAT)

VAT is a consumption tax. This means you pay it when you buy goods or services.

Current VAT rate in Nigeria: 7.5%

Important things to know:

- VAT is paid by the final consumer

- Businesses only collect VAT and remit it to FIRS

Practical examples:

- When you buy food at a restaurant, VAT is added

- When you pay for hotel accommodation, VAT is added

- When you pay for professional services, VAT may be charged

Salary earners and VAT:

A salary earner may not see VAT on their payslip, but they pay VAT daily when they:

- Buy fuel

- Eat at restaurants

- Pay for services

So, a salary earner can be paying up to three taxes at the same time:

- PAYE (from salary)

- Personal Income Tax

- VAT (when spending money)

4. Company Income Tax (CIT)

Company Income Tax is paid by registered companies on their profits.

Current structure (simplified):

- Small companies (low turnover): may be exempt

- Medium companies: reduced rate

- Large companies: standard rate

Example:

If a registered company makes profit at the end of the year, it must pay Company Income Tax to FIRS.

This tax is different from VAT.

5. Withholding Tax (WHT)

Withholding Tax is tax deducted at source when you receive payment for certain services.

It is not an extra tax, but an advance payment of income tax.

Practical examples:

- If a company pays a consultant ₦1,000,000, it may deduct 5% or 10% as WHT

- The consultant later uses the WHT credit to offset final tax

6. Stamp Duties

Stamp Duties is one tax many Nigerians pay without knowing.

It applies to:

- Bank transfers

- Legal documents

- Agreements

- Contracts

Bank Stamp Duties (Very common example):

When you transfer ₦10,000 and above, banks automatically deduct stamp duty (usually ₦50).

This is collected by banks and remitted to government.

So even if you are not working, you may still be paying stamp duties through bank transactions.

7. Capital Gains Tax (CGT)

Capital Gains Tax is paid when you sell assets at a profit.

Assets include:

- Land

- Buildings

- Shares

- Investments

Example:

If you bought land for ₦2,000,000 and later sold it for ₦5,000,000, the profit may be subject to Capital Gains Tax.

8. Education Tax

This tax is paid by companies, not individuals. It is used to fund tertiary education in Nigeria. It is calculated based on company profits and paid to FIRS.

9. Levies and Local Government Taxes

These are smaller taxes collected by local governments.

Examples include:

- Tenement rate

- Market levies

- Shop permits

- Signage fees

The New Tax Act and Recent Reforms

Under the new tax reforms and recent Finance / Tax Acts, government has:

- Improved tracking of income and transactions

- Increased collaboration between banks and tax authorities

- Tightened compliance for individuals and businesses

- Introduced clearer rules on exemptions and thresholds

One major focus is financial transparency. This means:

- Bank transactions are easier to trace

- Unexplained income may raise tax questions

- Proper narration and documentation of funds is now very important

Key Takeaways

- You may be paying tax even without realizing it

- Salary earners pay PAYE, PIT and VAT

- Business owners pay PIT, VAT, and possibly WHT

- Bank transfers attract stamp duties

- Proper records now matter more under the new tax laws

Understanding taxes helps you:

- Avoid penalties

- Plan better financially

- Run your business legally

FAQs

Can one person pay more than one tax in Nigeria?

Yes. One person can legally pay multiple taxes depending on their income and spending.

For example, a salary earner can pay:

- PAYE (deducted from salary)

- Personal Income Tax (through PAYE)

- VAT (when buying goods and services)

- Stamp duties (through bank transfers)

Is PAYE different from Personal Income Tax (PIT)?

PAYE is not a different tax. It is simply the method used to collect Personal Income Tax from salary earners.

If you are employed, your Personal Income Tax is collected through PAYE. If you are self-employed, you pay PIT through direct assessment.

Do salary earners pay VAT?

Yes, but indirectly.

VAT is not deducted from salary, but salary earners pay VAT when they:

- Buy fuel

- Eat in restaurants

- Pay for hotel services

- Purchase goods and services

So even if you earn a salary, you are still a VAT payer as a consumer.

Why do banks deduct ₦50 on some transfers?

That deduction is stamp duties.

When you transfer ₦10,000 and above, banks are required to deduct stamp duty and remit it to government.

It is a legal tax, not a bank charge.

If VAT is 7.5%, who actually pays it?

The final consumer pays VAT.

Businesses only:

- Add VAT to invoices

- Collect VAT from customers

- Remit VAT to FIRS

So VAT is your tax whenever you buy goods or services.

Is Withholding Tax (WHT) an extra tax?

No.

Withholding Tax is not an extra tax. It is an advance payment of income tax.

You can later use WHT receipts to offset your final tax liability.

Do unemployed people pay tax?

Yes, sometimes.

Even without a job, a person may still pay:

- VAT (when spending money)

- Stamp duties (bank transfers)

- Capital Gains Tax (if they sell assets at a profit)

8. Can government track my income through my bank account under the new tax law?

Under the new tax reforms and recent Tax Acts, government has improved:

- Financial data sharing

- Bank transaction monitoring

- Income verification

This is why proper transaction narration, records, and documentation are now very important.

See>>> How FIRS Will Use Technology to Track Tax Defaulters in Nigeria (New System Explained)

Do I need to register with the tax office if I’m self‑employed?

Yes.

If you are:

- A freelancer

- A trader

- A consultant

- A realtor or business owner

You are expected to register with your State Internal Revenue Service and file your Personal Income Tax.

What happens if I don’t pay tax?

Failure to comply with tax laws can lead to:

- Penalties

- Interest on unpaid tax

- Bank account restrictions

- Legal action in serious cases

The new tax reforms focus more on compliance rather than excuses.

- Follow me on TikTok for quick tips and behind-the-scenes tours

- Subscribe to my YouTube channel for in-depth videos and property showcases

- Follow me on Facebook for updates, listings, and real estate advice

Leave a Reply