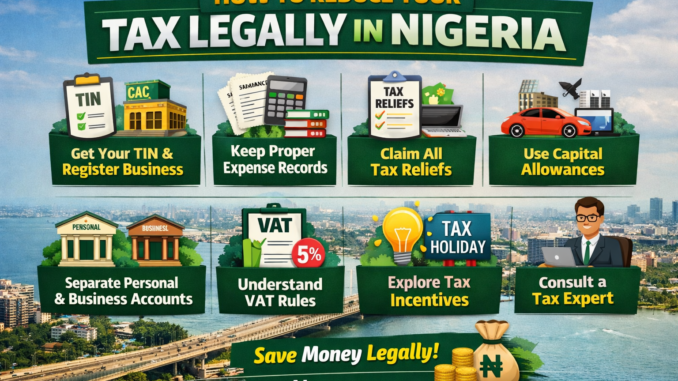

Tax is a compulsory obligation for individuals and businesses in Nigeria. However, paying more tax than required is not mandatory. With proper tax planning, you can legally reduce your tax burden, remain compliant, and keep more of your hard-earned money.

This article explains practical and legal tax planning tips in Nigeria that salary earners, freelancers, business owners, and investors can apply immediately.

Contents

- What Is Tax Planning?

- 1. Register Properly and Get Your TIN

- 2. Separate Personal and Business Finances

- 3. Keep Accurate Records of Expenses

- 4. Take Advantage of Allowances and Reliefs

- 5. Use Capital Allowances Wisely

- 6. Understand VAT to Avoid Overpayment

- 7. Choose the Right Business Structure

- 8. Pay Taxes Early and Avoid Penalties

- 9. Claim Available Tax Incentives

- 10. Consult a Tax Professional

- Frequently Asked Questions (FAQs)

- Is tax planning legal in Nigeria?

- What is the difference between tax planning and tax evasion?

- Who needs tax planning in Nigeria?

- Can small businesses legally pay less tax?

- Do salary earners really have tax reliefs in Nigeria?

- How does VAT affect my tax planning?

- Can registering my business reduce my tax?

- What happens if I don’t plan my taxes properly?

- Is hiring a tax consultant worth it?

- When should I start tax planning?

What Is Tax Planning?

Tax planning is the process of organizing your income, expenses, and investments in a way that minimizes your tax liability within the law. It is completely different from tax evasion, which is illegal.

Good tax planning helps you:

- Avoid overpayment

- Prevent penalties

- Improve cash flow

- Stay compliant with FIRS and State Internal Revenue Services

1. Register Properly and Get Your TIN

Many Nigerians pay more tax than necessary simply because they are not properly registered.

Ensure you have a Tax Identification Number (TIN)

File taxes under the correct category (sole proprietor, partnership, or company)

Proper registration allows you to enjoy tax reliefs, allowances, and exemptions.

2. Separate Personal and Business Finances

Mixing personal and business money can increase your tax liability.

Open a separate business account

Track only business income as taxable

Avoid classifying personal expenses as income

This helps you avoid paying tax on money that isn’t profit.

3. Keep Accurate Records of Expenses

Only profit is taxed, not total income.

Legitimate business expenses you can deduct include:

- Rent

- Salaries and wages

- Internet and phone bills

- Transportation

- Office supplies

- Marketing and advertising

Poor record-keeping can lead to higher tax assessments.

4. Take Advantage of Allowances and Reliefs

For salary earners, Nigeria’s tax law provides reliefs such as:

- Consolidated Relief Allowance (CRA)

- Pension contributions

- NHF and NHIS deductions

These reduce your taxable income, not your salary.

5. Use Capital Allowances Wisely

If you buy assets for business use (e.g. laptops, vehicles, machinery), you may qualify for capital allowances.

Instead of taxing you fully, the law allows you to:

- Spread the cost over time

- Reduce taxable profit yearly

This is a powerful tool for businesses.

6. Understand VAT to Avoid Overpayment

VAT is often misunderstood.

- VAT is not your income

- Only remit VAT collected on behalf of FIRS

- Claim input VAT where applicable

Many businesses overpay VAT simply because they don’t track it properly.

7. Choose the Right Business Structure

Your tax rate depends on how your business is structured.

- Sole proprietors are taxed under PIT

- Companies are taxed under CIT

- Some businesses may benefit from incorporation

Choosing the right structure can significantly reduce your tax exposure.

8. Pay Taxes Early and Avoid Penalties

Penalties and interest can increase your tax burden unnecessarily.

- File returns on time

- Pay assessed taxes promptly

- Avoid default fines

Good compliance is a form of tax savings.

9. Claim Available Tax Incentives

Nigeria offers incentives such as:

- Pioneer status

- Tax holidays for startups

- SME tax exemptions (based on turnover)

Many businesses don’t claim these simply because they’re unaware.

10. Consult a Tax Professional

Tax laws change, and misinterpretation can be costly.

A tax consultant can help you:

- Plan ahead

- Identify legal savings

- Avoid costly mistakes

This is often cheaper than paying excess tax or penalties later.

Frequently Asked Questions (FAQs)

Is tax planning legal in Nigeria?

Yes. Tax planning is 100% legal in Nigeria. It involves arranging your finances to take advantage of reliefs, allowances, and incentives provided by law. What is illegal is tax evasion, which means deliberately hiding income or falsifying records.

What is the difference between tax planning and tax evasion?

- Tax planning: Using legal methods to reduce tax payable

- Tax evasion: Hiding income, falsifying records, or refusing to pay tax

Tax planning keeps you compliant; tax evasion attracts penalties, fines, and possible prosecution.

Who needs tax planning in Nigeria?

Everyone who earns income, including:

- Salary earners

- Business owners

- Freelancers and digital marketers

- Real estate investors

- Online vendors and creators

If you earn money, tax planning applies to you.

Can small businesses legally pay less tax?

Yes. Small businesses can reduce tax legally by:

- Keeping proper expense records

- Claiming allowable deductions

- Benefiting from SME tax exemptions

- Choosing the right business structure

Many SMEs overpay tax simply due to poor documentation.

Do salary earners really have tax reliefs in Nigeria?

Yes. Salary earners enjoy:

- Consolidated Relief Allowance (CRA)

- Pension contribution deductions

- NHF and NHIS reliefs

These reduce taxable income, not salary.

How does VAT affect my tax planning?

VAT is not your income. You only collect it on behalf of the government.

Good VAT planning helps you:

- Avoid remitting excess VAT

- Claim input VAT where applicable

- Separate VAT from business revenue

Poor VAT handling leads to overpayment.

Can registering my business reduce my tax?

Yes. Proper registration with CAC and obtaining a TIN allows you to:

- Access tax incentives

- Enjoy business deductions

- Avoid arbitrary tax assessments

Unregistered businesses often pay more than necessary.

What happens if I don’t plan my taxes properly?

Poor tax planning can lead to:

Overpayment of tax

Penalties and interest

Cash flow problems

Issues with banks and investors

Tax planning saves money and protects your business.

Is hiring a tax consultant worth it?

Yes. A tax consultant helps you:

Identify legal tax savings

Avoid compliance mistakes

Stay updated with new tax laws

The cost is usually far less than penalties or excess tax paid.

When should I start tax planning?

The best time is before you earn income, not after.

Tax planning works best when done:

At the start of the year

Before major business decisions

Before filing tax returns

Final Thoughts

Tax planning is not tax evasion. It is the smart, legal way to organize your income and expenses so you only pay what the law requires—nothing more.

Whether you are a salary earner, freelancer, business owner, or investor, proper tax planning can save you money every year.

- Follow me on TikTok for quick tips and behind-the-scenes tours

- Subscribe to my YouTube channel for in-depth videos and property showcases

- Follow me on Facebook for updates, listings, and real estate advice

Leave a Reply