From January 1, 2026, Nigeria begins a major change in how taxes are collected. Many people have heard about “the new tax law” but don’t really understand what it means.

For many Nigerians, especially business people, freelancers, and salary earners, this law will change how you receive money, how you pay tax, and even how you operate your business.

This guide will help you understand exactly how the new system works, using simple explanations and easy examples.

Let’s break it down.

Contents

- What Is the New Tax Law About?

- The Nigeria Tax Act (NTA)

- What Changes for Salary Earners?

- Who Is Exempt From Tax Under the New Law?

- Understanding the Real Tax Rates (Not Everyone Pays 25%)

- PAYE Example: How Much Will You Pay?

- What Changes for Business Owners?

- What Does This Mean in Real Life?

- Why You Must Use a Company Account Instead of a Personal Account

- Tax on Companies vs. Tax on Individuals

- What Counts as Deductible Expenses?

- What Counts as Deductible Expenses?

- Every Bank Transaction Must Have a Narration

- How Will This Help Nigeria’s Economy?

- What About VAT?

- What About Digital Income?

- What About Stamp Duty and Other Levies?

- Who Will Feel the Biggest Impact?

- What Happens If You Don’t Comply?

- Industries and Sectors That Are Exempted or Favoured Under the New Law

What Is the New Tax Law About?

Before now, Nigeria had too many different tax laws:

VAT Act

Company Income Tax Act

Personal Income Tax Act

Capital Gains Tax Act

Stamp Duties Act

Tertiary Education Tax Act

Customs & Excise Acts…and many others.

Most people didn’t understand them, and many businesses were confused.

The new law changes everything.

From 2026, Nigeria will use one major law called:

The Nigeria Tax Act (NTA)

This doesn’t mean ALL taxes disappear, it means all the rules are now in one place, simpler to understand and easier to obey.

Think of it like this:

Old System:

10 jumbled textbooks with different rules, teachers, and instructions.

New System:

1 clean, organised textbook for all major taxes.

Why this change is good:

Removes confusion

Reduces mistakes

Stops double taxation

Helps businesses plan

Helps the government collect taxes fairly

Makes things easier for both citizens and companies

See>>> How FIRS Will Use Technology to Track Tax Defaulters in Nigeria (New System Explained)

What Changes for Salary Earners?

If you work for a company and receive a monthly salary, you pay PAYE (Pay As You Earn).

The new law will be very favourable to low and middle-income workers.

Key changes:

✔ Many low-income earners will pay little or no tax.

The government expanded tax-free allowances, meaning a lot of people earning small and moderate salaries may pay zero PAYE.

✔ Tax rate is more progressive.

This simply means the more you earn, the higher percentage you pay, but only on the higher portion.

Who Is Exempt From Tax Under the New Law?

The first major point is the ₦800,000 annual income exemption.

✅ If you earn ₦800,000 or less per year, you will not pay income tax.

This includes:

Salary earners

Small traders

Low-commission earners

Artisans

People with small side hustles

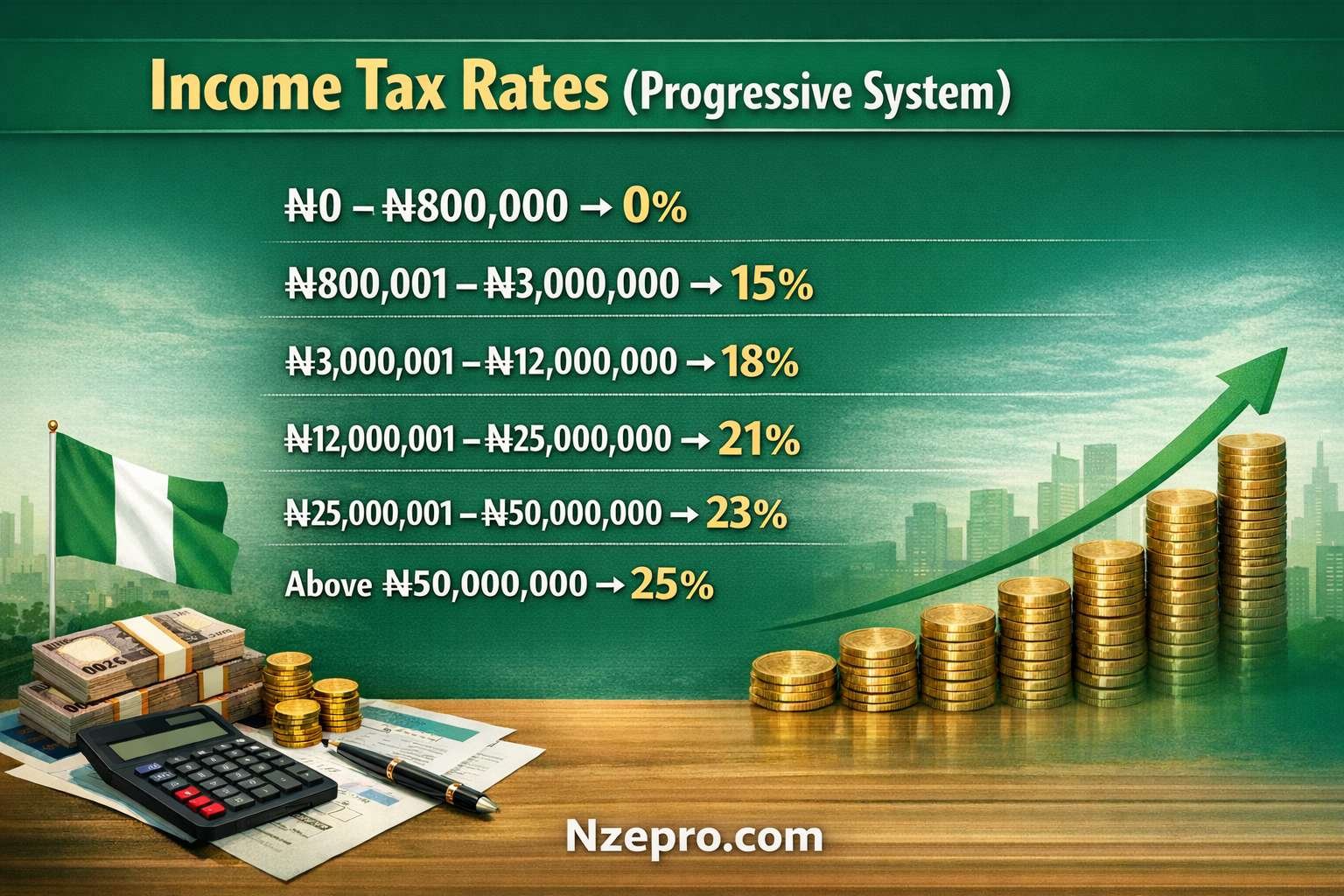

Understanding the Real Tax Rates (Not Everyone Pays 25%)

Many Nigerians online have misunderstood the new law and believe everyone will pay 25% tax.

This is not true.

The 25% rate only applies to extremely high incomes, not the average worker or small business.

Here is the simple breakdown for salary earners:

Income Tax Rates (Progressive System)

₦0 – ₦800,000 → 0%

₦800,001 – ₦3,000,000 → 15%

₦3,000,001 – ₦12,000,000 → 18%

₦12,000,001 – ₦25,000,000 → 21%

₦25,000,001 – ₦50,000,000 → 23%

Above ₦50,000,000 → 25%

What this means:

Most workers earning between ₦1m–₦5m/year will pay between 15–18%, after deductions.

Many low-income earners will pay 0%.

Only top earners (₦50m+ income) fall into the 25% category.

This corrects the false belief circulating online that “everyone will pay 25%”.

PAYE Example: How Much Will You Pay?

Let’s use a very simple example.

Example 1: Someone earning ₦120,000 monthly (₦1.44m yearly)

Under the old system, they paid some tax.

Under the new system:

After removing new reliefs (pension, rent relief, insurance, etc.),

The taxable amount becomes very small.

A person earning ₦120,000/month may end up paying ₦0 or less than ₦2,000/month depending on their deductions.

Example 2: Someone earning ₦300,000 monthly (₦3.6m yearly)

After deductions, taxable income reduces significantly.

This person may pay something around ₦10,000–₦20,000/month, depending on:

pension

housing costs

insurance

dependents

The advantage is:

More take-home pay, more money in your pocket.

What Changes for Business Owners?

This is one of the biggest parts of the reform.

The government wants to support small businesses because they employ most Nigerians.

Here is the new rule:

If your business has:

Annual sales (turnover) below ₦100 million, AND

Business assets below ₦250 million

Then you will NOT pay:

❌ Corporate Income Tax

❌ Capital Gains Tax

This is huge.

What Does This Mean in Real Life?

Let’s use very easy examples.

Example 1: A fashion designer

Turnover: ₦18 million/year

Assets: ₦5 million (machines, generator)

➡️ She pays ₦0 corporate tax.

➡️ She pays ₦0 capital gains tax if she sells anything.

Example 2: A mini-importation business

Turnover: ₦55 million/year

Assets: ₦3 million

➡️ No company tax.

Example 3: A small Leather Seller

Turnover: ₦120 million/year

Assets: ₦20 million

Even though assets are small:

📌 Turnover is above ₦100 million

➡️ They will pay corporate tax.

Example 4: A printing company

Turnover: ₦90 million

Assets: ₦300 million (big machines)

Even though turnover is small:

📌 Assets above ₦250 million

➡️ They must pay company tax.

Why You Must Use a Company Account Instead of a Personal Account

The new 2026 tax law strongly encourages businesses to operate with a registered company account (see how to register for a company name with CAC) rather than using a personal bank account. This is important for several reasons:

1. Clear Separation of Personal and Business Income

Banks and tax authorities now monitor inflows more closely.

If your business is using your personal account, every credit alert may be seen as personal taxable income.

This can lead to:

Wrong tax assessment

Double taxation

Unnecessary audits

With a company account, business income is clearly separated and taxed properly based on the business structure.

2. Access to Small-Business Tax Exemptions

One of the biggest benefits of the new tax law is:

✔ Businesses with turnover below ₦100m and assets below ₦250m

✔ Pay ZERO company tax

But you can only qualify for this if:

Your business is registered, and

You use a company bank account

If you mix business money inside your personal account, the tax authorities cannot classify you as a micro or small business under the exemption rule.

You automatically lose that benefit.

3. Avoiding Personal Income Tax on Business Money

If you receive ₦50m in your personal account from business operations, the government may treat it as:

Salary

Commission

Personal earnings

…and calculate PAYE or personal income tax on it.

But in a company account, that same ₦50m is seen as business revenue, not personal income.

4. Eligibility for Loans, Grants, and Compliance

Banks, government agencies, and investors now require:

CAC documents

Tax Identification Number

Company account history

Without a company account, your business will appear “informal”, blocking access to many opportunities.

5. Protecting Yourself Legally

Personal accounts make you personally liable for:

Debt

Business losses

Tax penalties

A registered company with a company account gives you limited liability protection.

Tax on Companies vs. Tax on Individuals

Many people don’t know that companies pay less tax than individuals, because companies are taxed on profit, not revenue.

Profit = Revenue – Expenses

This breaks down everything.

Individual vs. Company

Let’s say you run a phone accessories business:

You receive ₦3,000,000 in one year

Your expenses (rent, purchase, transport, data, repairs) total ₦1,800,000

If you run this in your personal account:

The system sees ₦3,000,000 income. You may be taxed based on full ₦3M.

If you run it through a company account:

Profit = ₦3,000,000 − ₦1,800,000 = ₦1,200,000

You will pay tax only on ₦1.2M.

This is a huge difference.

What Counts as Deductible Expenses?

Companies can reduce how much tax they pay through legitimate expenses.

Here are common deductible expenses:

Office/shop rent

Fuel for business mobility

Generator or electricity

Data for business

Staff salary

Payment to vendors

Cost of goods bought for resale

Repairs or maintenance

Professional fees

The more detailed your documentation, the lower your taxable profit.

What Counts as Deductible Expenses?

Companies can reduce the amount of tax they pay through legitimate expenses.

Here are common deductible expenses:

Office/shop rent

Fuel for business mobility

Generator or electricity

Data for business

Staff salary

Payment to vendors

Cost of goods bought for resale

Repairs or maintenance

Professional fees

The more detailed your documentation, the lower your taxable profit.

Every Bank Transaction Must Have a Narration

One of the strongest parts of the new law is transaction transparency.

The law requires that:

Every credit (money entering your account)

Every debit (money you send out)

must have a clear narration or description.

This means no more vague descriptions like:

“Cash”

“For something”

“Payment”

“Help me send this”

“Transfer”

Why?

Because tax assessments will rely heavily on your bank statements.

If money enters your account without explanation, it may be counted as income.

How Wrong Narration Can Affect You

A friend sends you ₦200,000 to hold, and the narration is just “Cash.”

During a tax review, the system may classify this as income.

You may be taxed for money that is not even yours.

So what should narrations look like?

“Loan from Emeka”

“Refund for wrong debit”

“Reversal for product damaged”

“Capital contribution from partner”

“Payment for Toyota Camry spare parts”

Clear, exact, and easy to understand.

How Will This Help Nigeria’s Economy?

✔ More money stays with small businesses

This means they can hire more people, buy more machines, expand faster, and survive economic challenges.

✔ Encourages young entrepreneurs

You can start a business without fear of heavy taxation.

✔ Reduces tax pressure on honest businesses

People who want to follow the law will find it easier.

✔ Government can focus on big companies

And not chase small shops, POS agents, online sellers, tailors, and mini businesses.

What About VAT?

VAT is still 7.5%

But the system is easier to manage because the VAT rules are now inside the Nigeria Tax Act.

Small businesses with turnover less than ₦25 million do not need to charge VAT, the same as before.

What About Digital Income?

This one is important.

The new tax law will tax online income and freelance income properly.

This includes earnings from:

TikTok

YouTube

Freelancing (Upwork, Fiverr)

Influencing

Online trading

Remote jobs

Crypto profits

This doesn’t mean you pay tax on everything it means if you profit, the profit becomes taxable.

Example:

If you buy crypto for ₦1,000,000 and sell for ₦1,300,000:

Profit = ₦300,000

This ₦300,000 is what tax applies to.

Not the full amount.

What About Stamp Duty and Other Levies?

Many old levies have been removed or merged to reduce confusion.

Stamp duty, for example, is now inside the new law and has clearer rules.

A new 4% development levy applies to some companies, mainly larger ones.

Small businesses still remain safe under the exemption rule.

Who Will Feel the Biggest Impact?

Salary Earners:

Most will take home more money, especially low and middle earners.

Small Businesses:

Most will pay no company tax at all.

Big Companies:

They will pay more and comply with stricter rules.

Digital Workers:

Will be required to declare income properly.

What Happens If You Don’t Comply?

The new law empowers authorities to:

- Review your bank statements

- Demand proof of any inflow

- Fine you for wrong or incomplete narration

- Charge you for undeclared income

- Penalize you for poor record-keeping

This is why structure matters in 2026.

Industries and Sectors That Are Exempted or Favoured Under the New Law

The government created tax exemptions and reliefs for key economic sectors to support local production and reduce the cost of essential goods.

Here are the major sectors that enjoy exemptions or reduced tax obligations:

1. Food and Essential Consumables

Food sellers, market traders, and businesses dealing in basic food items benefit from:

Tax exemptions

No VAT on certain staple foods

Lower regulatory burden

This supports the affordability of food across the country.

2. Agriculture (Crop, Fishery, Livestock)

Agriculture remains one of the most supported sectors.

Benefits include:

Tax holidays

Exemption from company tax (if turnover is below the threshold)

Exemption from certain levies

Lower duties on equipment

This makes farming more profitable and reduces food insecurity.

3. Transportation (Local Transportation Services)

This includes:

Bus transport

Keke operations

Taxi services

Intra-city movement

These sectors are exempt from certain tax categories, making transportation more affordable.

4. Small-Scale Manufacturing

Small producers of:

Soap

Water

Furniture

Garments

Household items

…qualify for company tax exemptions if turnover and asset limits are met.

5. Education and Training Services

Schools, training centres, and skill-development institutions enjoy reliefs to encourage learning.

6. Micro-Businesses in General

Nearly all micro and small businesses benefit from:

Zero company tax

Zero capital gains tax

Simpler compliance

Fewer levies

As long as turnover is below ₦100m and assets are below ₦250m.

Conclusion: What You Should Remember

Here are the easiest points to keep in mind:

✔ Nigeria now has one major tax law instead of many confusing ones.

✔ Many salary earners will pay lower tax or no tax.

✔ Small businesses with turnover below ₦100m and assets below ₦250m will pay zero company tax.

✔ Digital income and crypto gains will now be taxed when profit is made.

✔ The new system is designed to be simpler, fairer, and easier to obey.

✔ Register a company or LLC You can contact us company for registration.

✔ Open a business account

✔ Separate your personal and business finances

✔ Label all your transactions clearly

✔ Track your income and expenses

✔ Keep receipts and records

✔ File taxes correctly

- Follow me on TikTok for quick tips and behind-the-scenes tours

- Subscribe to my YouTube channel for in-depth videos and property showcases

- Follow me on Facebook for updates, listings, and real estate advice

Leave a Reply